when will i receive my unemployment tax refund 2021

The IRS plans to send another tranche by the end of the year. The federal tax code counts jobless benefits.

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

At this stage unemployment compensation received this calendar year will be fully taxable on 2021 tax returns.

. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year. Tax season started Jan. The American Rescue Plan Act of 2021 excluded up to 10200 in unemployment compensation per taxpayer from taxable income paid in 2020.

Why is my tax refund so low in 2020 there may be different causes for 2019 returns filed in. The American Rescue Plan exempted 2020 unemployment benefits from taxes. Receiving 2020 unemployment tax refund.

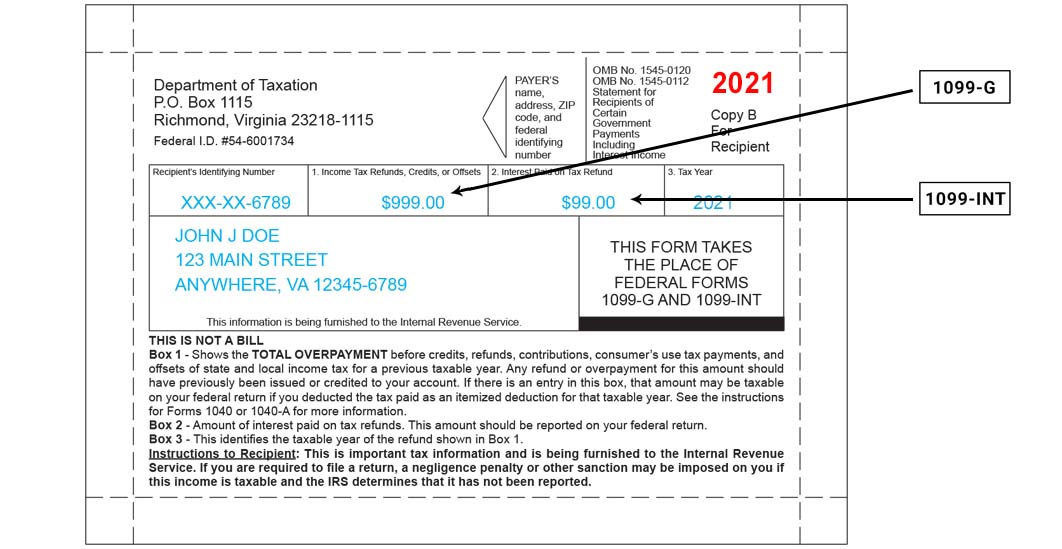

The first 10200 of 2020 jobless benefits 20400 for married couples filing jointly was made nontaxable income by the American Rescue Plan in March. When youre ready to file your tax return for 2021 write the amount stated in box 1 of your Form 1099-G on line 7 of Schedule 1 Additional Income and Adjustments to Income. Is due me and I have no.

11 2021 Published 106 pm. They fully paid and paid their state unemployment taxes on time. Deduct any of the taxes paid in 2021 because they relate to the 2020 property tax year and you didnt own the home.

By Anuradha Garg. July 29 2021 338 PM. The unemployment rate skyrocketed in the US.

With millions of Americans filing for unemployment benefits. If you received unemployment you may find the exclusion will reduce your taxable income and may provide you with an increased refund. This applies both.

Previous Years IRS Collections Back Taxes. Filed return in March. The 10200 tax break is the amount of income exclusion for single filers not the amount of the refund.

55 4 votes So if your tax refund is less than expected in 2021 it could be due to a few reasons. People who received unemployment benefits last year and filed tax. Some taxpayers will receive refunds which will be issued periodically and some will have the overpayment applied to taxes due or other debts.

The IRS might seize your unemployment. Has anyone had any luck going either of these routes. The Department of Labor has not designated their state as a credit.

If you paid taxes on unemployment benefits received in 2020 you might get a refund or the IRS could seize it. September 13 2021. For married individuals filing a joint tax return this.

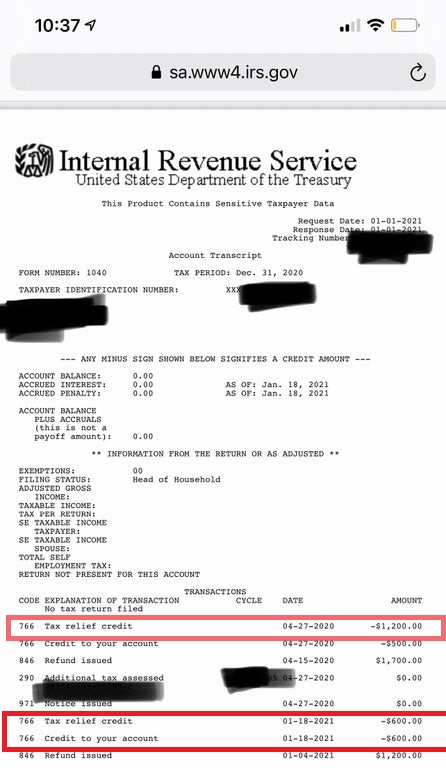

I recently contacted tax advocate and my local Congress representative. Line 7 is clearly labeled Unemployment compensation 4 The total amount from the Additional. IR-2021-71 March 31 2021 To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this spring and summer to people who filed their tax return reporting unemployment compensation before the recent changes made by the American Rescue Plan.

22 2022 Published 742 am. The amount of the refund will vary per person depending on overall income tax bracket and how much earnings came from. The agency had sent more than 117 million refunds worth 144 billion as of Nov.

From 2021 the FUTA tax rate is 60 and it applies to the first 7000 in annual wages paid per employee. Under the American Rescue Plan Act of 2021 Americans who received unemployment compensation in 2020 received relief. You did not get the unemployment exclusion on the 2020 tax return that you filed.

This is available under View Tax Records then click the Get Transcript button and choose the federal tax option. I have not rceived my tax return you filed it on march 28 2021. That provision didnt apply to 2021 benefits so you may receive a tax bill for your jobless benefits last year.

Account Services or Guest Services. As far as I know refund has not hit my bank yet. Thousands of taxpayers may still be waiting for a.

Have not received refund for 2021. If you use Account Services select My Return Status once you have logged in. The update says that to date the IRS has issued more than 117 million of these special refunds totaling 144 billion.

Im still waiting on the tax refund Im supposed to receive for the unemployment income I received in 2020. Thats the same data. You may check the status of your refund using self-service.

The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020. You didnt withhold your unemployment income. For some there will be no change.

1 You will get an additional federal income tax refund for the unemployment exclusion if all of the following are true. For individuals it excludes up to 10200 of their unemployment compensation from their gross income if their modified adjusted gross income is less than 150000. You must file Schedule 1 with your Form 1040 or 1040-SR tax return.

The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer. When you create a MILogin account you are only required to answer the verification questions one. After this you should select the 2020 Account Transcript and scan the transactions section for any entries as Refund issued.

Since May the IRS has been making adjustments on 2020 tax returns and issuing refunds averaging around 1600 to those who can claim an unemployment tax break. 24 and runs through April 18. The Earned Income Tax Credit EITC is a refundable tax credit for low-to-moderate income workers who have worked and earned income under the amount of 57414 in 2021 along with meeting certain other criteria.

Has seen a spike since October in legal questions from readers about layoffs unemployment and severance. During the month November the IRS might surprise you with a deposit or an extra refund check for your 2020 taxes. The IRS considers unemployment benefits taxable income When filing this spring your unemployment checks from 2021 will be counted as income taxed at your regular rate.

There are two options to access your account information. Another way is to check your tax transcript if you have an online account with the IRS. A refund of 4500.

Because unemployment benefits are not considered earned income receiving unemployment rather than wages or salary may reduce. Your employer on the other hand may be eligible for a credit of up to 54 of FUTA taxable wages if. You reported unemployment benefits as income on your 2020 tax return on Schedule 1 line 7.

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

Will My Irs Tax Transcript Help Me Find Out When I Ll Get My 2022 Refund And What Does It Mean When Transcript Says N A Aving To Invest

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

1099 G Unemployment Compensation 1099g

2021 Unemployment Benefits Taxable On Federal Returns Abc10 Com

About 7 Million People Likely To Receive Tax Refund On Unemployment Benefits

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

Waiting For Your Unemployment Tax Refund About 436 000 Returns Are Stuck In The Irs System

Time Running Out For Ohioans Claiming 2017 Tax Refund

1099 G 1099 Ints Now Available Virginia Tax

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

What To Keep In Mind About Your Unemployment Tax Refunds Wztv

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

2021 Unemployment Benefits Taxable On Federal Returns Abc10 Com

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor